CruiseControlling Ruby 1.9.2 and Rails 3.0.2

CruiseControl for Ruby from ThoughWorks has long been one of the easiest ways to your rails project under

continuous integration.

But there's still an issue that it can't

run under Ruby 1.9.x. That's not very good if you are targeting 1.9.2 for your project.

Here's a quick recipe for how you can build a 1.9.2 project with CC, using the

wonders of rvm..

# download and unpack CC to /usr/local/cruisecontrol-1.4.0 (or where you like)

# for convenience, add .rvmrc in /usr/local/cruisecontrol-1.4.0 to have it run 1.8.7

echo "rvm 1.8.7-p302" > /usr/local/cruisecontrol-1.4.0/.rvmrc

# configure CC:

cd /usr/local/cruisecontrol-1.4.0

./cruise add my_project_name --source-control git --repository git@github.com:myname/myproject.git

# ^^ This will initialize the ~/.cruise/projects/my_project_name folder for a git-based project

# if you have an .rvmrc file in your git repo, pre-emptively trust it to avoid clogging CC:

mkdir ~/.cruise/projects/my_project_name

rvm rvmrc trust ~/.cruise/projects/my_project_name

In ~/.cruise/projects/my_project_name, edit cruise_config.rb to run a shell script instead of the standard build task (I'm calling it ccbuild.sh and it will be in the root of my git repo):

Project.configure do |project|

# [.. other stuff ..]

project.build_command = './ccbuild.sh'

# [.. other stuff ..]

end

Add ccbuild.sh to your repository (don't forget to chmod u+x it). It needs to ensure rvm script is loaded and activate the correct ruby & gemset.

The script initialization is necessary because it seems the way CC spawns the shell script it doesn't pick up the rvm initialization you might already have in .bash_profile. Without rvm script initialization, "rvm" will invoke the binary which can't make the direct environment mods it needs to do.

Here's what I have in ccbuild.sh:

#!/bin/bash

if [ "$(type rvm | head -1)" != "rvm is a function" ]

then

source ~/.rvm/scripts/rvm || exit 1

fi

if [ "$(type rvm | head -1)" != "rvm is a function" ]

then

echo "rvm not properly installed and available"

exit 1

fi

rvm use 1.9.2-p0@mygemsetname --create

bundle check || bundle install || exit 1

rake # setup to run all required tests by default

Once that's checked in and pushed to the repo, you can kick-off CC:

cd /usr/local/cruisecontrol-1.4.0

./cruise start

Now my ccmenu is green, and CruiseControl is running my project under 1.9.2 and rails 3.0.2;-)

Blogarhythm: Waiting for the light ART-SCHOOL

read more and comment..

Rock till you drop.io

Bombshell announcement on 29-Oct: drop.io have .. struck a deal with Facebook.

What this means is that Facebook has bought most of drop.io’s technology and assets, and Sam Lessin is moving to Facebook.

drop.io was widely acclaimed as the simple file sharing mechanisms we all needed. It resolutely solved the problem that everyone with a computer and a network connection has known at one time or another: how to share files too cumbersome for email, without resorting to techno-geekery like ftp and such. And it worked. Beautifully.

But it doesn't work anymore.

Goodbye drop.io! You were an amazing service. One of the best and brightest of the Class of Web 2.0. You made things simple. You solved a real, pressing problem.

Unfortunately, that's not what I'll remember you for now.

Instead, it will be for brewing a thunderstorm of concern over the very dependability of cloud services, as John C. Dvorak went to town on in his column.

And for teaching us that it's true - startup founders really don't give a toss for their customers if they can get a sweet deal and a plum job with one of the heavyweights instead.

And for once again propelling Facebook into the privacy-conspiracy-theory limelight. Sure, "no data will be transferred to Facebook", but they put you out of business and bought "most of [your] technology and assets", right? So will we be surprised when Facebook takes aim to lure it's unsuspecting users into sharing pretty much anything and everything - private, commercially confidential, and otherwise - using Facebook?

Well, I guess drop.io does really deserve our thanks for that last point, if anyone cares to notice.

The

very best news—for anyone who can't imagine life without drop.io—is that there is another exceptional product out there

called Dropbox that can handle most team sharing needs in addition to looking

after your personal documents.

The

very best news—for anyone who can't imagine life without drop.io—is that there is another exceptional product out there

called Dropbox that can handle most team sharing needs in addition to looking

after your personal documents.That's not a paid advertisement or anything. I simply use Dropbox everyday and just love it. I wouldn't be exaggerating to say it's probably improved the way I work more than anything even the folks in Redmond or Cupertino have shipped in recent memory.

Blogarhythm: Rock Rock (till you drop) .. Def Leppard

read more and comment..

The Ultimate Steampunk Project needs $10

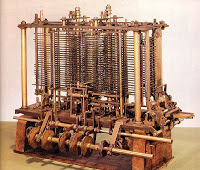

I heard John Graham-Cumming on TWiT

#269 talk about the project he has started to build - 173 years later - a full scale realization of Charles

Babbage's Analytical Engine. Amazingly, it's never been done (only partial models exist).

I heard John Graham-Cumming on TWiT

#269 talk about the project he has started to build - 173 years later - a full scale realization of Charles

Babbage's Analytical Engine. Amazingly, it's never been done (only partial models exist).

Now, we are talking about a truck-sized, steam-powered machine that is Turing-complete and features (without silicon or

electricity) "modern" ideas like instruction pipelining. The ultimate steampunk project. It also has a serious educational and academic aspect

(including to digitize all of Babbage's plans and notes).

Due to significant private support coming forth, the pledge target has apparently been reduced from 50,000 to just

10,000 signatories. At the time of writing, John only needed another 6358 pledges of $10/£10/€10 each to get the

project moving.

Now I don't often get behind fundraisers and campaigns, but this strikes me as one of those once-in-a-lifetime follies

you cannot help but support. And all for about the price of the cheapest bottle of wine in the shop around the

corner.

Blogarhythm: L.O.V.E.

Machine WASP

read more and comment..

What if? Journalists had to reference sources...

No matter how they're viewed at home, the BBC remains in my view the international gold standard for news, information,

and entertainment. God bless'em. And could you imagine any other "news organisation" (a.k.a. pernicious purveyors of

distracting deceits) going so far as to require ".. inline links must go to primary sources only– eg scientific journal

article or policy report .. " in their new linking guidelines?

You can find a brilliant argument for why this might be a good idea in Ben Goldacre's book

Bad Science: Quacks, Hacks, and Big Pharma Flacks which I've recently read and cannot recommend too highly

for anyone with half a brain.

Blogarhythm: Don't

Lie - Black Eyed Peas

Update 17-Oct-2011: Ben Goldacre had a good rant

about Bad Science at TED this year:

read more and comment..